As mentioned earlier, it is best to focus on the levels of GED – Gross External Debt, when evaluating country risk and solvency, together with its maturity profile in order to assess immediate liquidity considerations. This is a more fundamental and stable measure of indebtedness than “sovereign debt”, which can have any number of definitions, such as:

For the time being, it would be important to confirm whether the loans now being repaid with the aid of the Treasury ( empréstimos agora vencidos) had been previously acquired, prior to maturity, in the secondary markets at discount, by local public or private investors, thus allowing Portugal to at least capture some of the benefit of the sacrifices suffered by the more risk-averse external creditors.

Mariana Abrantes de Sousa

PPP Lusofonia, PORTUGAL

- Direct financial debt of the State (, including Central, Regional and Local Governments (Republic, Azores, Madeira and municipalities)

- Direct financial debt of the Public Administration, including the State, as above, plus the State guaranteed debt (aval do Estado) and the debt of State-owned entities which Eurostat/INE may classify as part of Public Administration, from time to time (ex. Estradas de Portugal, REFER, Metros, hospitals, municipal companies, etc). This is the “Maastricht criteria” debt, based on the national accounts as prepared by INE/Eurostat, and is quite volatile and unreliable as borrowers are reclassified, sometimes retroactively.

The Gross External Debt includes all the public external debt of the Public Administration (as defined above) which is held by foreign creditors/investors at any one time, plus all the private external debt, which includes banks (funding for mortgages and for PPP project finance loans), corporations (State-owned and private sector companies) and even households.

Only the Gross External Debt includes the debt of the State-owned corporations still classified by Eurostat/INE as mercantile (ex. CP, Parpublica, TAP, etc) and the PPP obligations, which may have to be paid by the taxpayers rather than through user-fees.

Note that reclassification of State-owned companies from the “mercantile” to the Public Administration by Eurostat/INE does reclassify their debt (Republic Guaranteed or not) as “Public Administration debt) but does not change its legal status, nor the legal obligor/guarantor, nor the effect of any contractual cross-default clauses.

Given the dimension of the debt of the State-owned companies, much of it held by local banks, the Republic (Tesouro), in its shareholder function has, in practice, made loans to these companies to allow them to meet their maturing debt obligations, even those which are not Republic guaranteed, since these public service providers cannot “shut down”.

Thus the Portuguese Treasury extended EUR 1.3 Bln in loans to State-owned companies in the second quarter of 2011.

Now , it has been announced even prior to relevant maturity that Treasury will provide for the repayment of EUR 200 million by Metro do Porto to PNB Paribas in mid-August.

Now , it has been announced even prior to relevant maturity that Treasury will provide for the repayment of EUR 200 million by Metro do Porto to PNB Paribas in mid-August.

In the first trimester, the Portuguese Treasury had made only EUR 32 million as shareholder loans to State-owned companies which still had access to the market for refinancing purposes. (concedidos pelo Tesouro tinham sido apenas 32 milhões de Euros)

State-owned companies have significant amounts of debt coming due over the next quarters.

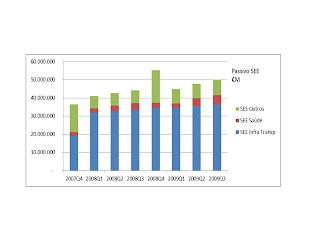

See Iceberg of Government contingent liabilities

See Iceberg of Government contingent liabilities

This Treasury assistance in repaying the non-guaranteed debt of State-owned companies represents, to some extent, the "nationalization" of the creditors exposure to these companies (SOE/SEE). In the case of deficit-prone companies that are not yet reclassified by Eurostat/INE as part of Public Administration, these Treasury credits may be reclassified by Eurostat/INE as capital increases, which will have an impact on the AP/Public Administration deficit for the purposes of the Maastricht criteria.

These repayments represent an enormous refinancing effort on the part of the Portuguese Treasury, which benefits the (mostly external) creditors directly, as shown in the latest repayment, those who over-extended “unguaranteed” credit to weak companies. These “clean” unguaranteed credits, which were quite unrestricted and were favoured by both the borrowers and the lenders, are now receiving the same repayment terms as Republic-guaranteed loans which were tightly restricted by the limits approved by Parliament (AR) in the annual budget law (OE).

This is an example of moral hazard, and another argument in favour of reclassiffication of ALL State-owned and Municipal-owned companies which have operating deficits two consecutive years as part of Public Adminisration , in order to place them under the strict budget discipline of the DGO-Budget Directorate and of Parliament (AR) through the budget (OE) law.

This would imply that ALL public investment should again be included in the Budget (OE) law and subject to prior Parliamentary approval. The list of central Government investment project, PIDDAC, should be transformed into PIDDAPA, the "Programa de Investimentos e Despesas de Desenvolvimento da Administração Pública Alargada, including all the State-owned and municipal companies and PPP concession contracts, with liabilities up-dated annually. This would ensure transparency and would force all PPP liabilities, including REF rebalancings and other add-ons, to be subject to the same overall budget restriction regardless of the contractual form used.

This would imply that ALL public investment should again be included in the Budget (OE) law and subject to prior Parliamentary approval. The list of central Government investment project, PIDDAC, should be transformed into PIDDAPA, the "Programa de Investimentos e Despesas de Desenvolvimento da Administração Pública Alargada, including all the State-owned and municipal companies and PPP concession contracts, with liabilities up-dated annually. This would ensure transparency and would force all PPP liabilities, including REF rebalancings and other add-ons, to be subject to the same overall budget restriction regardless of the contractual form used.

For the time being, it would be important to confirm whether the loans now being repaid with the aid of the Treasury ( empréstimos agora vencidos) had been previously acquired, prior to maturity, in the secondary markets at discount, by local public or private investors, thus allowing Portugal to at least capture some of the benefit of the sacrifices suffered by the more risk-averse external creditors.

Mariana Abrantes de Sousa

PPP Lusofonia, PORTUGAL

De Abril a Junho 2011, o Tesouro fez empréstimos de 1300 milhões de euros, incluindo:

REFER - 434 milhões de euros

CP - 250 milhões de euros

Metro do Porto - 175 milhões de euros

Metro de Lisboa - 167 milhões de euros

RTP- 150 milhões de euros

EDIA - ... milhões de euros

EVC - ... milhões de euros

Frente Tejo - 3,6 milhões de euros, empresa a extinguir

REFER - 434 milhões de euros

CP - 250 milhões de euros

Metro do Porto - 175 milhões de euros

Metro de Lisboa - 167 milhões de euros

RTP- 150 milhões de euros

EDIA - ... milhões de euros

EVC - ... milhões de euros

Frente Tejo - 3,6 milhões de euros, empresa a extinguir

…

Metro do Porto – 200 milhões de euros, BNP Paribas

See: Off-budget liabilities of SOE/SEE and PPP

http://ppplusofonia.blogspot.com/2009/12/encargos-extra-orcamentais-com-servicos.html

http://ppplusofonia.blogspot.com/2011/08/divida-de-empresas-publicas-passa-para.html

http://ppplusofonia.blogspot.com/2011/05/midgets-cant-guarantee-intra-eurozone.html

Sources; DGTF EFE

http://www.ionline.pt/conteudo/140332-estado-emprestou-1300-milhoes-aos-transportes-e--rtp-em-tres-meses

http://www.destakes.com/redir/bcf1e32d860b84b50059e70215c5b99a

http://www.netconsumo.com/2011/08/estado-emprestou-1300-milhoes-aos.html

See: Off-budget liabilities of SOE/SEE and PPP

http://ppplusofonia.blogspot.com/2009/12/encargos-extra-orcamentais-com-servicos.html

http://ppplusofonia.blogspot.com/2011/08/divida-de-empresas-publicas-passa-para.html

http://ppplusofonia.blogspot.com/2011/05/midgets-cant-guarantee-intra-eurozone.html

Sources; DGTF EFE

http://www.ionline.pt/conteudo/140332-estado-emprestou-1300-milhoes-aos-transportes-e--rtp-em-tres-meses

http://www.destakes.com/redir/bcf1e32d860b84b50059e70215c5b99a

http://www.netconsumo.com/2011/08/estado-emprestou-1300-milhoes-aos.html

It's a bird ...

ResponderEliminarIt's a plane...

It's superdebt!

A extinção da Parque Expo faz sentido desde que se garanta a continuidade da sua experiência e conhecimentos no desenvolvimento e requalificação urbana.

ResponderEliminarVery interesting considerations. Now just imagine that, for some reason, a speculative fund knows that the Tesouro will indeed repay the non-guaranteed debt of State-owned companies... It could buy the bonds at a discount and then, suddenly, the bonds magically become State-guaranteed debt that can be sold at a much lower discount...

ResponderEliminarAre you sure that some people have not made a lot of money very quickly?

Yes, many investors have certainly made a lot of money.

ResponderEliminarThat's why most of the distressed Eurozone debt is now with Asset Managers and Hedge Funds rather than with banks.

That's why the bailout money should be used to allow the borrowing countries to buy back this debt at deep discounts and to retire it, thus capturing the benefit of the discount.

Distressed debt trading is big business.

Means and Purpose Test:

ResponderEliminarBack then, the US Comptroller of the Currency banking regulator allowed banks to apply a "Means and Purpose Test", to determine whether a borrower should be treated as (quasi)sovereign risk or not. This test was reviewed annually.

First, the purpose:

The SOE or other borrower is NOT mandated to carry out an essencial governmental function no a tradidional non-commercial public (good) service? If is not engaged in purely commercial activity, it should be classified as part of Public Administration and included in sovereign risk exposure.

Then, the means:

Does the borrower which is mandated to provide a commercial public service have the sufficient commercial/mercantile means to do it, without having to rely on immediate or future taxpayer funding? If not self-sustainable without tazpayer money, then the unsustainable or structurally deficit borrower should be treated as part of Public Administration and included in the sovereign risk exposure.

The implication for borrowers which fail the Means and Purpose Test, from the PFM public financial management perspective, is that these "quasi-sovereign" borrowers should be managed and subjected to the same budgetary discipline as any regular Government borrowers. This is because the investors will expect it and they will impose "cross-defaul tpenalties" on the Governments, whether the cross-default clauses exist or not.

That's the moral hazard on the part of Governments.

IMF dixit:

ResponderEliminarPortugal has 3X (three times!) more PSOE than Germany (?)

1:00

Portuguese banks are more leveraged than Greek banks?

A tutela de Obras Públicas e Transportes pode ser vista como uma SGPS (holding company) gigante, provavelmente a maior do país.

ResponderEliminarAs diversas empresas do sector deveriam deveria ser consolidadas na Tutela, para conhecermos a verdadeira dimensão do sector e dos seus encargos.

Tale of two cities:

ResponderEliminarMetropolitano de Lisboa

Metro do Porto

Estado vai pagar dívida da RTP (200M€) e já este ano comprou o arquivo histórico por 150M€

ResponderEliminarMoody's corta rating da REFER e CP devido ao elevado montante de dívida que vence nos próximos 12 meses

ResponderEliminarIt's a bird, it's a plane...

ResponderEliminarIt's a huge hidden deficit!

Estado assume divida das empresas de transportes, o que promove o "moral hazard" dos credores

ResponderEliminarhttp://economico.sapo.pt/noticias/estado-assume-dividas-das-empresas-publicas-de-transportes_138697.html

As empresas públicas têm ordem para vender imobiliário não afecto à actividade principal para conseguirem reduzir a dívida.

ResponderEliminarTudo bem, desde que não vendam a outras empresas públicas como a Sogestamo e que não fiquem a pagar rendas a fundos de investimento colocados junto de aforradores incautos.

E que os prédios passem a pagar IMI e não fiquem abandonados.

Foreign creditors threw credit at the state-owned companies like REFER, without even asking for state guarantee.

ResponderEliminarNow, analysts are suggesting that the Government force a restructuring of this non-guaranteed debt, with longer tenors, lower rates and partial forgiveness, loans which were unsustainable from the day they were made.